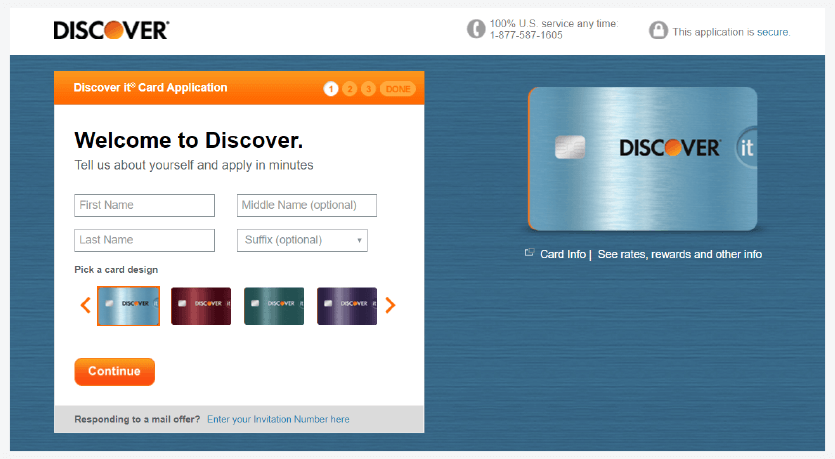

If all of that spending is put on the card, the cardholder would earn an additional $200.72. We estimated the remaining annual household credit card spending is $26,072. When maxed out, a cardholder can earn $300.00 from the bonus categories. Discover maxes out quarterly earnings bonuses at $1,500 per quarter (or $6,000 per year) after which the earnings rate drops down to an unlimited 1%. Government data, most families spend at least $1,500 per quarter on the bonus categories Discover consistently uses. The 70th percentile of wage earners bring in $107,908 annually and we base spending on that number. Forbes Advisor uses data from various government agencies to determine both baseline income and spending averages across various categories. To determine the rewards potential of the Discover it® Cash Back card we have to look at the bonus categories and calculate what an American household might spend in those areas. Cash back can also be redeemed directly at Amazon or PayPal. Redeeming RewardsĬash back can be redeemed for any amount, at any time in the form of a statement credit or electronic deposit.

There's no minimum spending or maximum rewards. Categories have historically included gas stations, restaurants,, Target, grocery stores and more.Īdditionally, Discover will automatically match all the cash back earned at the end of the first year as a cardmember. Plus, earn unlimited 1% cash back on all other purchases – automatically.

The Discover it® Cash Back earns 5% cash back on everyday purchases at different places each quarter up to a quarterly maximum of $1,500 in spending when activated.

0 kommentar(er)

0 kommentar(er)